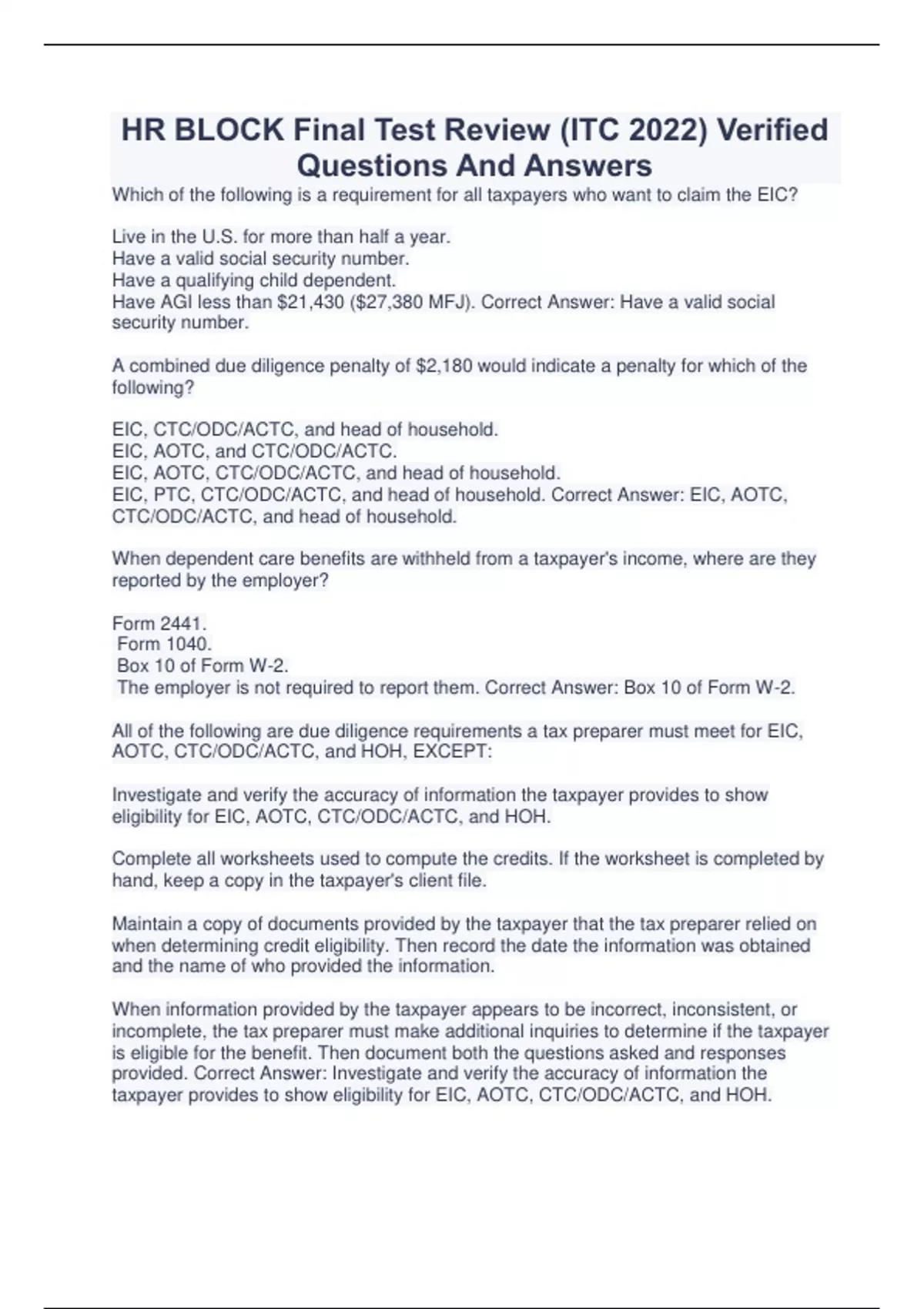

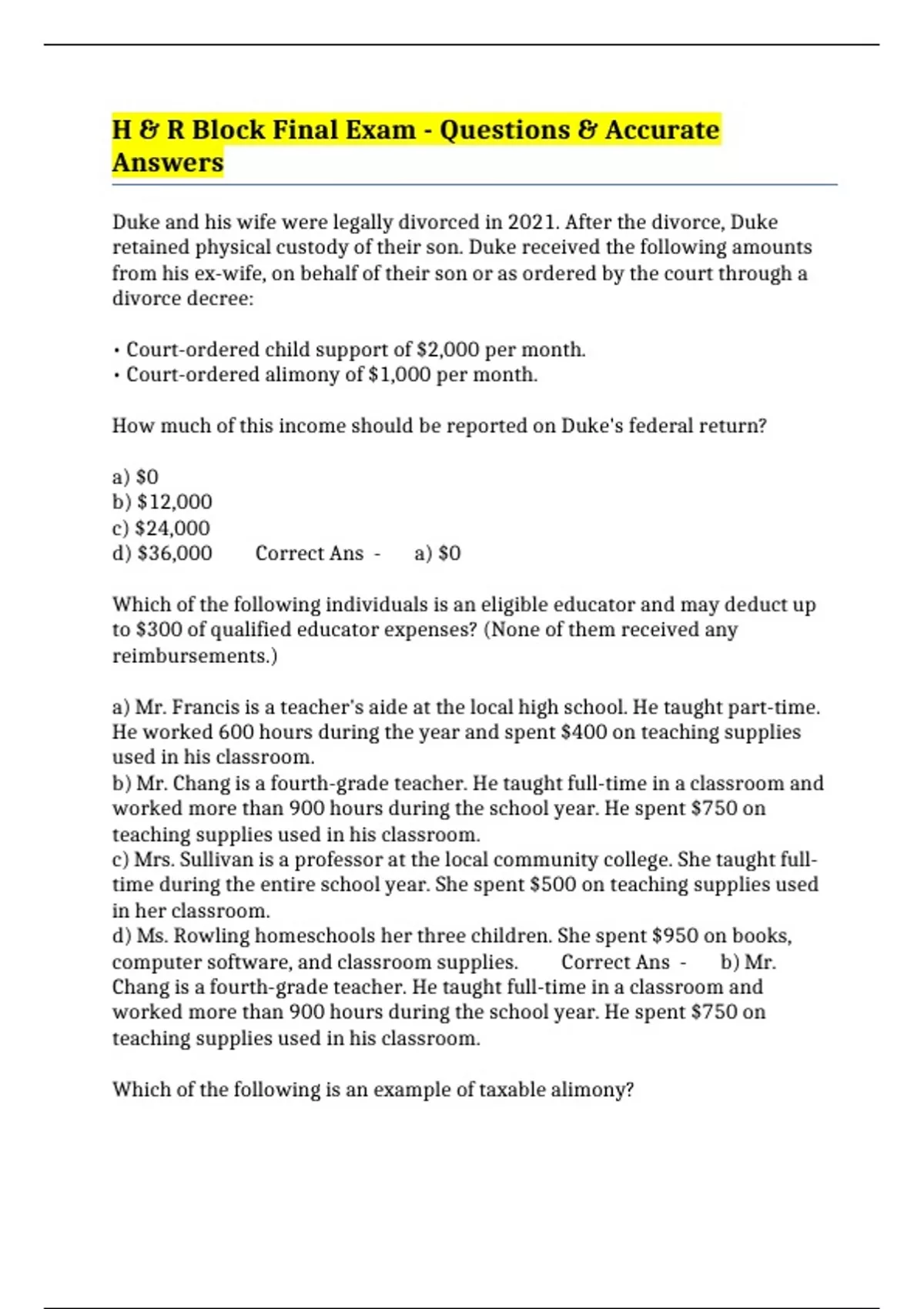

Webhe borrowed $900,000 and purchased a new main home in march of 2020. Soledad will be itemizing his deductions. On what portion of the acquisition debt will interest be deductible on soledad's tax return for 2022? Complete questions & answers (grad... Webwith these case studies, you will be able to identify the where, how, what, and how of the h&r block final exam case study answer. Some of the main characteristics of descriptive case studies include: Web3 days ago · study with quizlet and memorize flashcards containing terms like which of the following is a requirement for all taxpayers who want to claim the eic? Live in the u. s. For more than half a year. Have a valid social security number.

Related Posts

Recent Post

- Anonymous Std Text Notification

- Polk County Arrest Reports

- Theync Channel

- 168 Bus Schedule Nj Transit

- The Loud House Fanart Deviantart

- 24 Hour Vape

- House Of Day Funeral Home Toledo Ohio Obituaries

- Plasma Center Wilson Nc

- Volusia County Mugs

- Wonderful Weekend Gif

- Hertz Rent To Own Program

- Va Doc Jobs

- Tribune Obituaries San Luis Obispo

- Fatal Car Accident Rhode Island Yesterday

- List Of Dhar Mann Actors

Trending Keywords

Recent Search

- Free Stuff Los Angeles Ca

- Mugshots Pitt County Nc

- York Dispatch Obituary York Pa

- Leo Burlsworth

- National Weather Doppler Radar Loop

- Amazon Delivery Drivers Jobs

- Marketplace Saginaw

- San Angelo Live Crime News

- Lancaster Pa Crime Watch

- Middle River Busted Newspaper

- Music Funeral Home Valdosta Georgia Obituaries

- Post Journal Obituaries Jamestown New York

- Ottumwa Evening Post Obits

- Harnett 24 Hour Arrest

- Santa Rosa County Fl Mugshots